VALUE

ADDED TAX (VAT)

Introduction

Concept of VAT

VAT Rates according to the White Paper

Key features for VAT in T++

VAT Rate Classification in T++

Enabling VAT in T++

Ledger Creation for VAT in T++

F12: Configuration for VAT in T++

Voucher Entries for VAT in T++

Reports for VAT in T++

What is VAT?

Value Added Tax (VAT) is an indirect taxation system, which has been

introduced in place of sales tax and also to ensure a fair and uniform system

of taxation. It is the tax paid by the manufacturers, producers, retailers or

any other dealer who add value to the goods. Main

advantage of VAT is that it reduces the double taxation of same goods and gives

benefit to the end user by reducing the price of the product.

Concept of VAT

The essence of VAT is in providing set-off

for input tax and this is applied through the concept of input credit (rebate).

This input credit in relation to any period means setting off the amount of

input tax by a registered dealer against the amount of his output tax. The VAT

is based on the value addition to the goods, and the related VAT liability of

the dealer is calculated by deducting the input credit from the tax collected

on sales during the payment period.

In other words VAT works in two different ways:

Vat Payable - If VAT-registered businesses receive more output tax (means tax on sales) than the taxes

paid as input tax (tax on purchase),

they will need to pay the difference to the Commissioner of Taxes (State)

Vat Refundable - If the input tax paid is more than the output tax

collected, you can carry forward the Input credit and adjust it against the

output tax in the subsequent months.

Note: You can have the Input Credit (is the amount of Input tax that is

permitted to be set off against Output tax.) refunded to you at the end of the

current or following year, by the Government. You can receive refunds for Input

Credit on (exports) within a period of three months

VAT Rates according to the White Paper

There are 550 categories of goods under the VAT system. They are

classified into the following four groups, depending on the VAT rate:

1) Exempted from VAT - There are about 46 commodities under the exempted category. This

includes a maximum of 10 commodities that each state would be allowed to

select, from a broader approved list for VAT exemption. The exempted commodities include natural and

unprocessed products in unorganized sector as well as items, which are legally

barred from taxation.

2) VAT @ 1% - This is for a specific category of goods like gold, silver, etc.

3) VAT @ 4% - The largest number of goods (220) comprising of basic necessity items

such as capital goods, declared goods, drugs and medicines, agricultural and

industrial inputs, are under 4% VAT rate.

4) VAT@12.5% - The remaining commodities are under the general VAT rate of 12.5%.

Note: The few goods that are outside VAT as a matter of policy would

include liquor, lottery tickets, petroleum products, as the prices of these

items are not fully market-determined. These items will continue to be taxed

under the sales tax act of the respective states.

Key features for VAT in T++

The VAT functionality in T++ supports the following key features,

making it easier for computation:

·

Fast & error-free voucher

entry

·

Complete tracking of each

transaction till annual returns

·

Monthly Return

·

Pre-defined list of sales

& purchase classifications

·

Printing of Tax invoice

·

VAT computation report

·

VAT- returns management

VAT Rate Classification in T++

These are pre-defined in T++ and will be updated if and when any legal changes

take place. Some of the classifications are:

For Purchases Account

InputVAT@1%

InputVAT@4%

InputVAT@12.5%

Purchases - Capital Goods,

Purchases – Exempt

Purchases from unregistered dealers

Purchases – Inter State Purchases

Purchases – Others

Consignment/Branch Transfer Inward

For Sales Accounts

OutputVAT@1%

OutputVAT@4%,

OutputVAT@12.5%

Sales – Exempt

Sales – Inter State Sales

Sales – Import

Consignment/Branch Transfer Outward

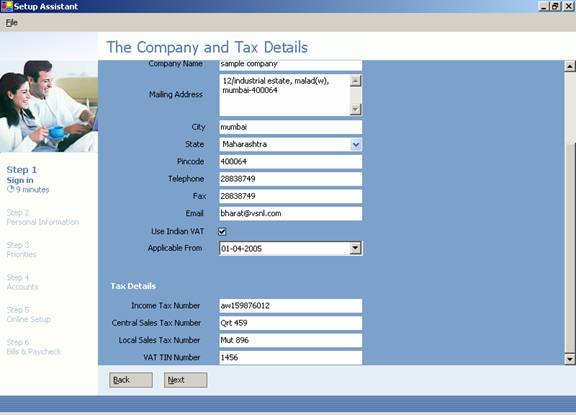

Enabling VAT in T++

You can

enable T++ VAT during Company Creation and Alteration as screen shown below.

![]()

![]()

![]()

![]()

Step 1

In State

select the State from the Drop down list.

Step 2

In Use

Indian VAT just click to set it to yes.

Step 3

In Applicable

From please mention the date from which VAT is applicable.

Note: The VAT date should be greater than or equal to the Company’s current

date, (e.g. Company’s Financial Year is 01.04.2005 to 31.03.2006 the VAT date

should be either 01.04.2005 or between 01.04.2005 to 31.03.2006)

Step 4

In VAT

TIN No. Enter TIN number in this field. The Tax Payer’s Identification

Number (TIN)

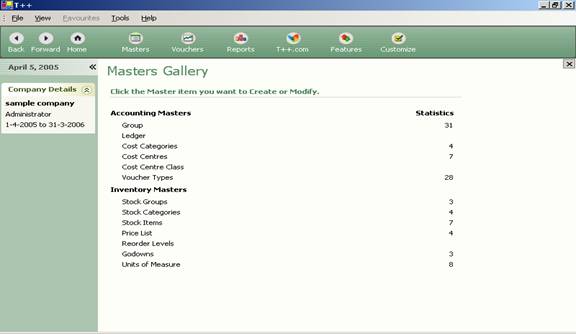

Ledger Creation for VAT in T++

In Masters

Gallery

The Ledgers which are affected by VAT are as follows.

·

Purchase Ledger

·

Sales Ledger

·

Duties and Taxes Ledger

·

Direct Expenses/Income.

·

Fixed Assets Ledger

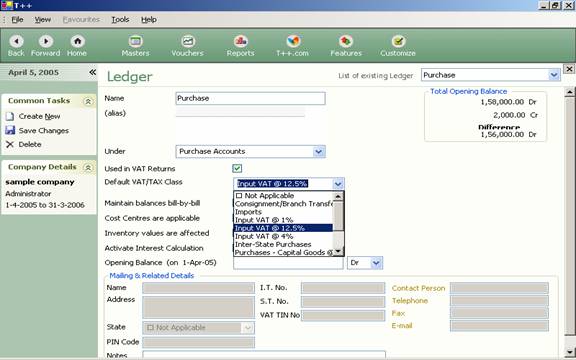

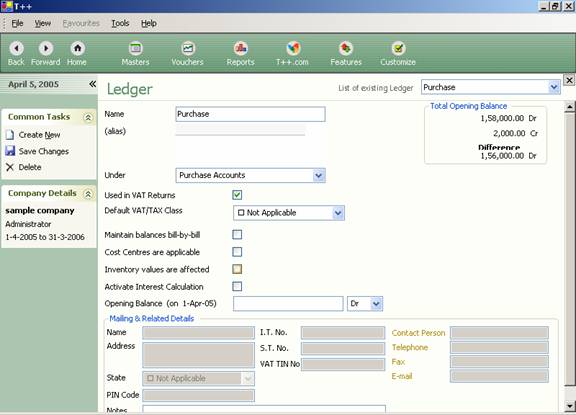

a) The

following additional fields, pertaining to VAT, are same for Purchase Ledger,

Sales Ledger, Direct Expenses, Direct Income &

Fixed Assets and in the Ledger entry screen as below.

![]()

![]()

Step 1

In Used in VAT Returns click to set this to yes if you wish to

select VAT classifications for this Ledger. Once you set this to Yes, you will

see the Default VAT/Tax Class field.

Step 2

In Default VAT/Tax Class select the required classification here

from the list. The list consists of the Purchase or Sales classifications

pertaining to your state. If you do not wish to select a classification at the

Ledger level, you can set this to Not Applicable.

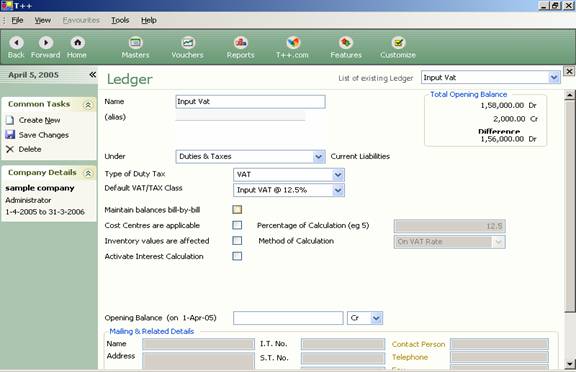

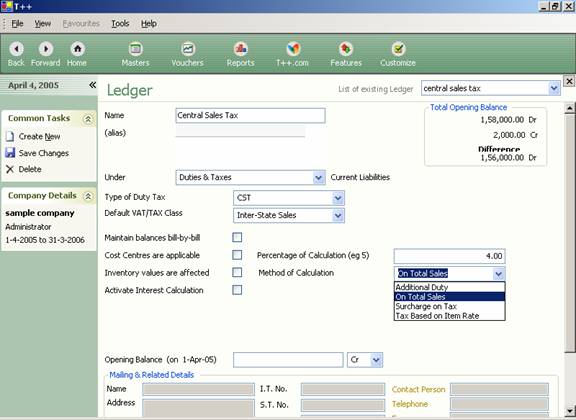

b) The

following additional fields, pertaining to VAT, can be seen in the Ledger entry

screen below. As one can create Input

VAT ledger, Output VAT and CST etc under Duties & Taxes

![]()

Other

best example is of CST Ledger creation under Duties & Taxes

![]()

Step 1

In Type

of Duty/Tax On the selection of group Duties and Taxes, the list of Tax

Types CST, Others and VAT, is displayed. Select VAT for VAT related

transactions.

Note:

If you have VAT and TDS enabled, the list will also include TDS.

Step 2

In Default

VAT/Tax Class – is as similar as in the Purchase and Sales Ledger, this is

a drop down list containing the VAT classifications.

Step 3

In Percentage

of calculation - This will auto display the VAT rate that you selected in

the Default VAT/Tax class field.

Step 4

In Method

of calculation -This will auto display On VAT Rate if you have selected VAT

under Type of Duty/Tax.

Note: Similarly for Output VAT which is used

for VAT Sales.

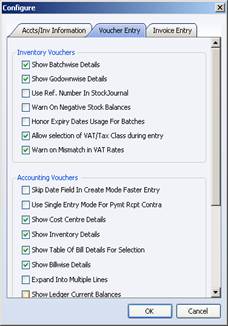

F12: Configuration for VAT in T++

Before entering vouchers for Purchase invoice and Sales invoice for VAT

Classification. The following settings are required to set in the F12:

Configuration as screen given below.

![]()

Step 1

You have the option in Voucher Entry under Inventory Vouchers just

click the select Allow Selection of VAT/Tax Class during entry to set VAT

Applicable for Vouchers mode and Invoice mode. If it is not selected, the VAT/Tax

Class will not be displayed in the voucher screen and the classifications will

be taken from the Ledgers.

Note: You have the option Warn

on Mismatch in VAT Rates under Inventory Vouchers when you select it to Yes it displays an Message or Warning for mismatch in VAT

Rates during the Voucher Entry.

Step 2

When you wish to use more than one purchase or sales ledger during a

voucher transaction, you need to unclick Use Common Ledger A/c for Item

Allocation under Invoices / Delivery Notes/ Others in Invoice Entry. This way,

you need to select a ledger for every item during voucher entry. As the

following settings are required to set in the F12: Configuration as screen

given below

![]()

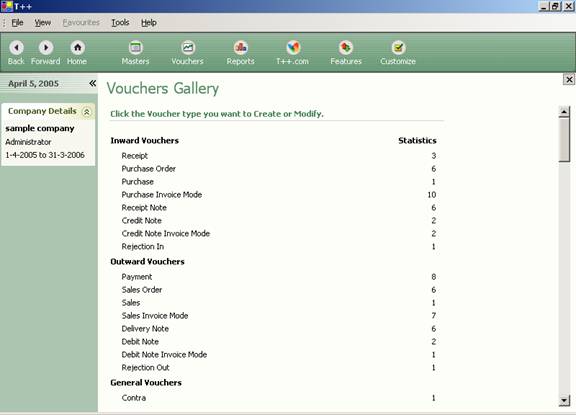

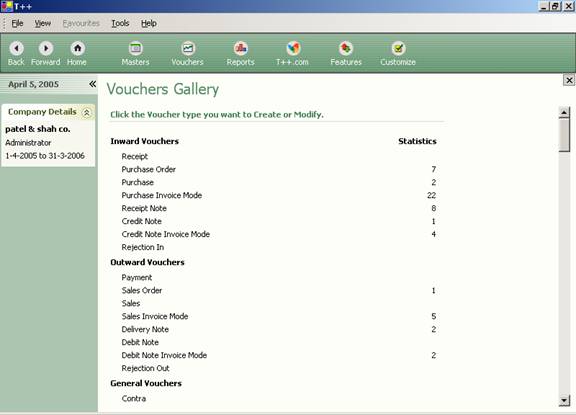

Voucher Entries for VAT in T++

In Vouchers Gallery

The

Vouchers that are affected by VAT are as follows:

·

Purchase

·

Sales

·

Debit Note

·

Credit Note

·

Journals

Given

below are examples of transactions in Item Invoice with implementation of VAT.

Note: You can also go through the Sample Company (received free with the

software) for more examples.

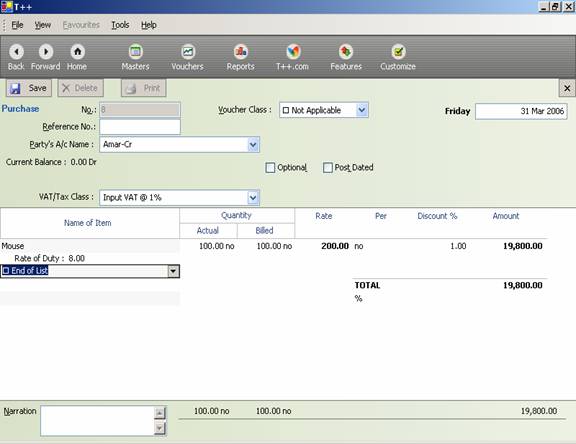

Purchase Voucher (As Invoice)

Example 1:

The following is the entry for the

purchase of Mouse when VAT

classification is Purchase@1%. Here

the Use

Common Ledger A/c for Item Allocation it not selected so it does not displays

the Purchase Ledger.

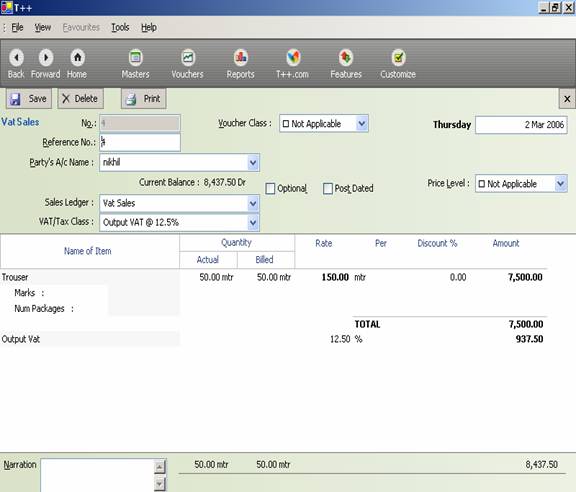

Sales Voucher (As Invoice)

Example 2:

The following is the entry for the Sales

of Trouser when VAT classification

is Output VAT 12.5%. Here the Use Common Ledger A/c for Item

Allocation is selected so it does displays

the Sales Ledger.

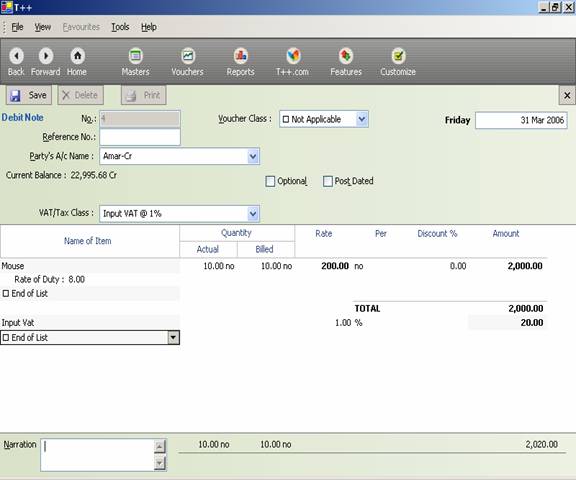

Debit Note (As Invoice) – Purchase Return

Example 3:

The following is the entry for the

Debit Note against Purchase entry of Mouse

when VAT classification is Input VAT 1%.

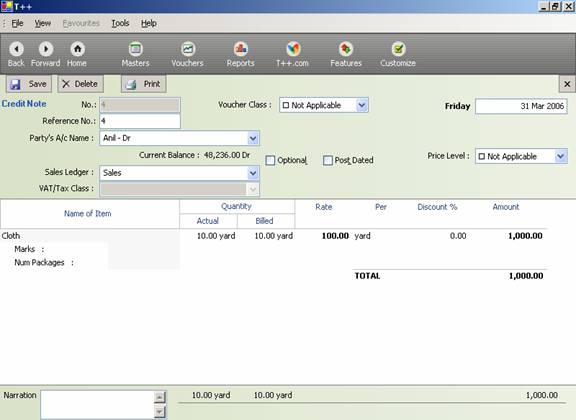

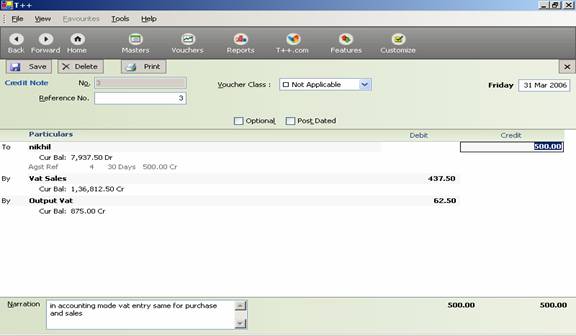

Credit Note (As Invoice) – Sales Return

Example 4:

The following is the entry for the Credit

Note against Sales entry of Cloth

when VAT classification is Output VAT

1%.

Note: When you entry in Debit Note voucher or

Credit Note voucher it selects the default VAT Class Tax as per the transaction

as entered in Purchase Invoice and Sales Invoice.

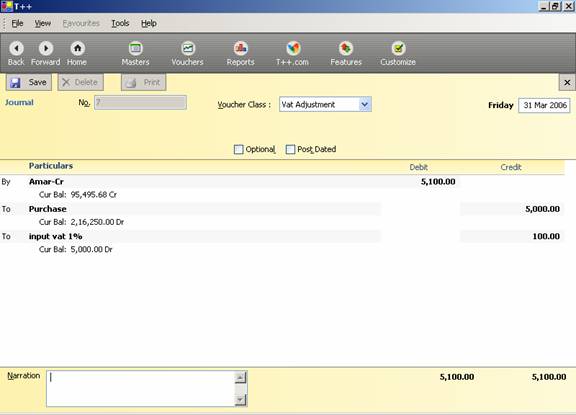

Journal – for VAT Adjustment

For VAT

Adjustment and to display affect in the VAT Computation Report, you need the

Journal transactions and for that you need to create a Journal Class in Voucher

Type.

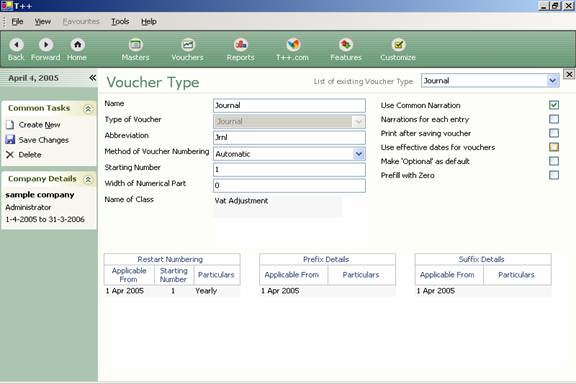

Step 1

Go to

Master Gallery click the Voucher Type under Accounting Masters. By Press Esc

Button you will be in Alter mode. Now select Journal from List of Existing

Voucher Type as you will see the following screen below:

Step 2

In Name

of Class insert Name the voucher

class. In the above example, we have named it as VAT Adjustment. Once you hit

enter, you will see the following screen

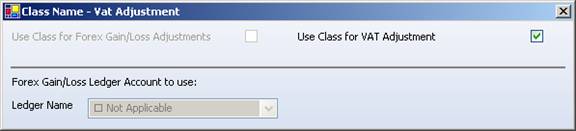

Step 3

In Use

Class for VAT Adjustments As the name implies, you

will need to click to set it to Yes if you want the journal entries to be

included in VAT computation.

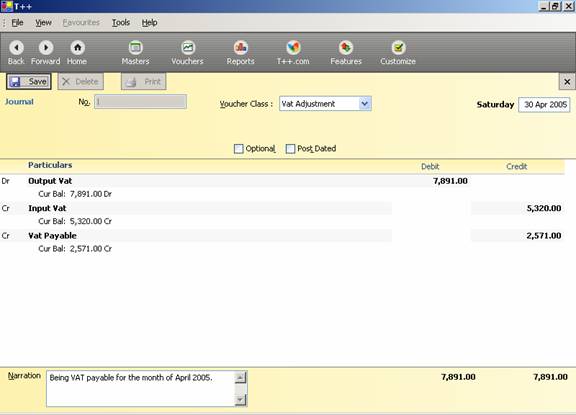

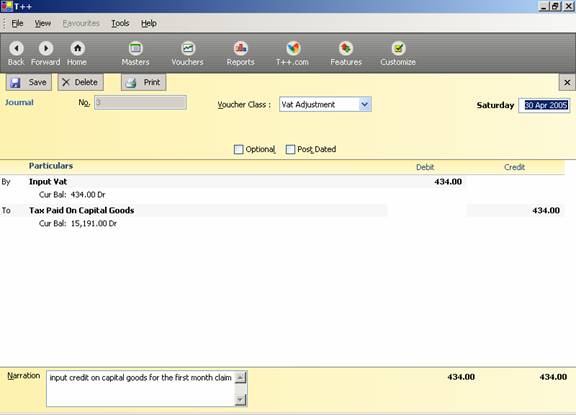

Example 5:

The

following screen below is an example for VAT Adjustment through Journal Entry

Note: The VAT payable Ledger is under the

group Current Liabilities

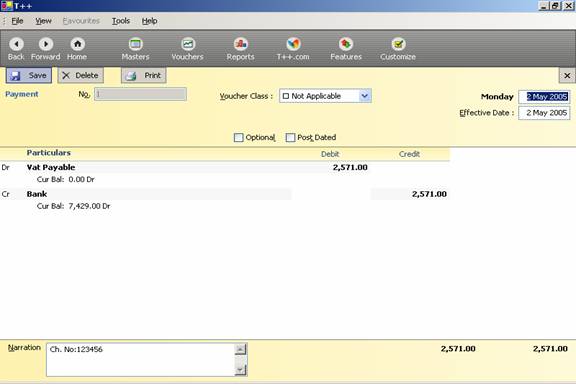

Step 4

Example 6:

The following screen below is Payment

entry entered for the VAT payable; Rs.2,571.00 /- is transferred to the Cash or Bank account.

Example 7:

Input Credit Adjustment for Capital Goods

As per

the rule of government credit of tax paid on capital goods is claimed in instalment

of 36 month however state government has power to reduce the number of

instalments. It can be understood better from following example:

Let Purchase

Capital Goods of under class of 12.5% of Rs.1, 25,000 /-

And

input tax is Rs.15, 625/- which will be available for 36 month instalments

Now in

the first month I claim credit of Rs.434.03 (i.e. 15625/36 = 434.03)

I

passed the journal entry as follow:

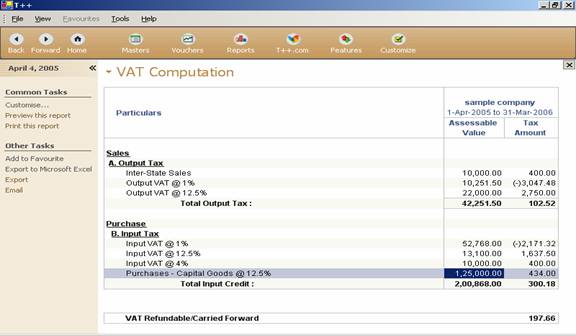

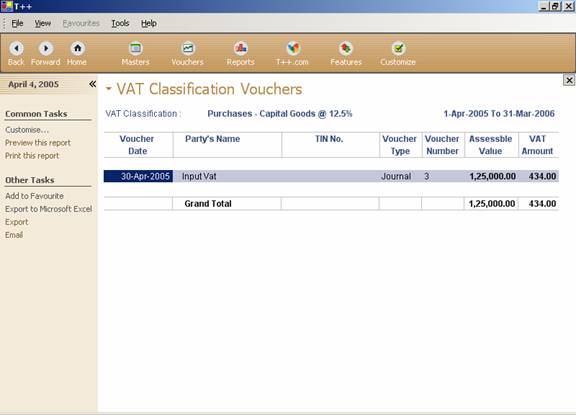

In

VAT report the effect of above journal voucher shown as follow:

Reports for VAT in T++

The Report Gallery

![]()

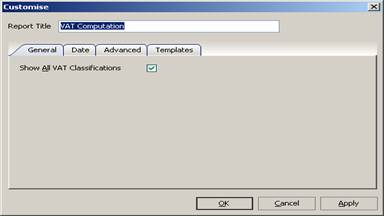

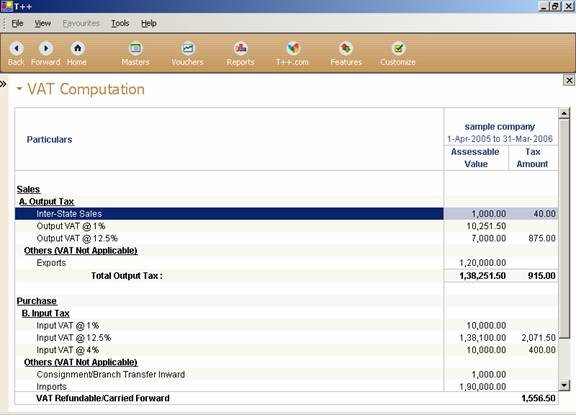

VAT Computation – (click on VAT Computation)

In the

following screen below of VAT Computation Report it displays the Assessable

Value and VAT amount taxable on Assessable Amount for Sales under A. Output

Tax and Purchase B. under Input Tax.

At the end it displays the Total VAT

Refundable / Carried Forward.

For VAT Exempted or Others Entries where VAT is not applicable

If you

have transactions that are exempted from VAT but however want to have it

displayed in the VAT Computation screen, you will need to click on the

Customize and click on Show All VAT classifications and click OK button as

screen shown below.

Now you

will be able to see those transactions

that are exempted from VAT but however want to have it displayed in the VAT

Computation screen as below.

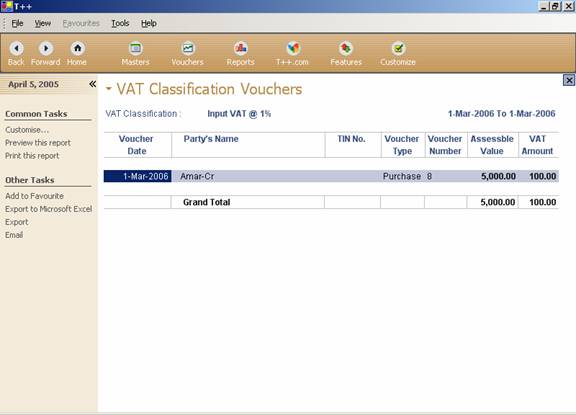

When

you want the Detail information of a particular transaction you can press, Enter

button on any of the selected VAT Taxes. In the following report you see the

detail information of VAT Classification – for INPUT VAT @ 4%

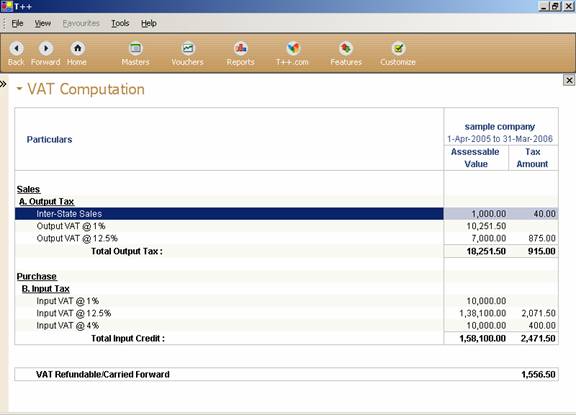

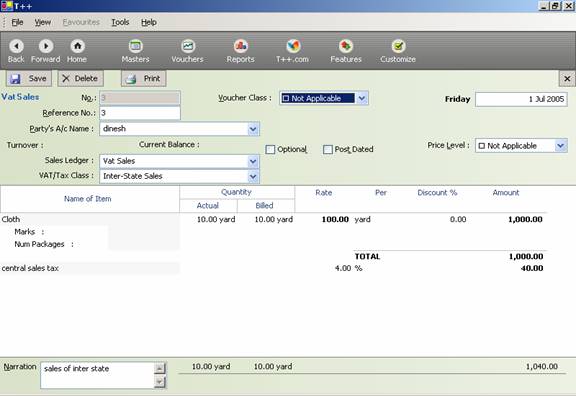

Report for Inter State Sales

The

following example below displays the effect in VAT Computation Report of

Inter

State Sales as on 1st July 2005 were Assessable Value is of Rs. 1000/- and CST Amount is of Rs.

40/-

And the

following Voucher Entry is an example of the above Inter Sate Sales

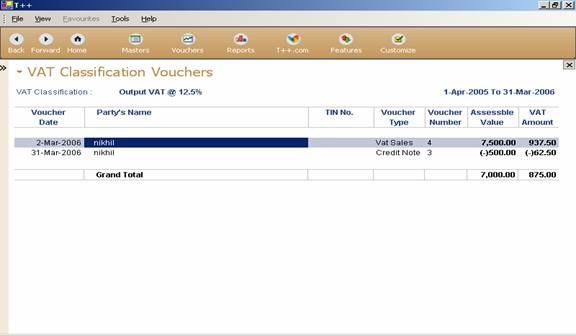

Sales Return - Credit Note

In the

following example below it displays the effect in VAT Computation of Sales

invoice entry as on 2nd Mar 2006 of Rs.

7500/- were VAT Amount payable is Rs. 937.50/- as

well as Credit Note entry on 31st March 2006 which Output VAT 12.5%

was applicable.

And the

following Voucher Entry is an example of the above Sales Return

Note: One can enter the same way entries for

Purchase Entry and Debit Note.

Giving effect of VAT in VAT Computation Report without Inventory

(i.e. In Accounting mode or when only Accounts Only is

selected while creating New Company)

Create

purchase ledger in master as follow:

Case 1: In master gallery > ledger > press enter

![]()

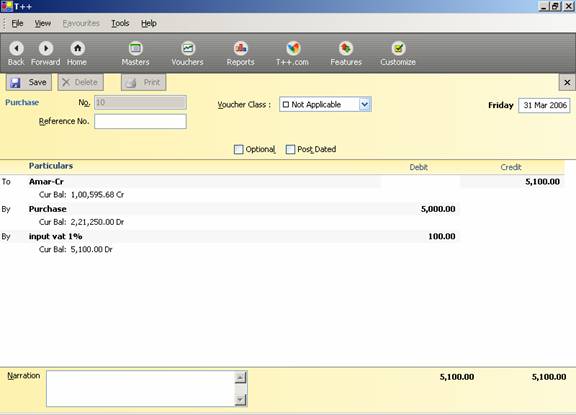

Case 2: Through Purchase Voucher

Select

Purchase under Inward Vouchers from Vouchers Gallery as shown below:

![]()

Enter the entry as shown in screen below through Purchase Voucher:

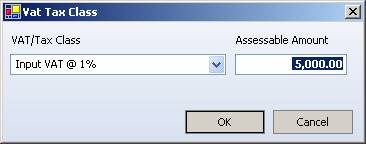

While

entering in the Purchase Ledger following form opens for VAT Tax Class. Select the required Class and enter purchase

assessable amount.

Effect

of above entry shown in VAT Computation Report as follow:

Note: One can enter the same way for Sales

Entries

Case 3: Through Journal Voucher

We can

also enter the same entry as in entered in Purchase Voucher as shown above

Through Journal Voucher only you have to select Vat Adjustment Class as screen

shown below.